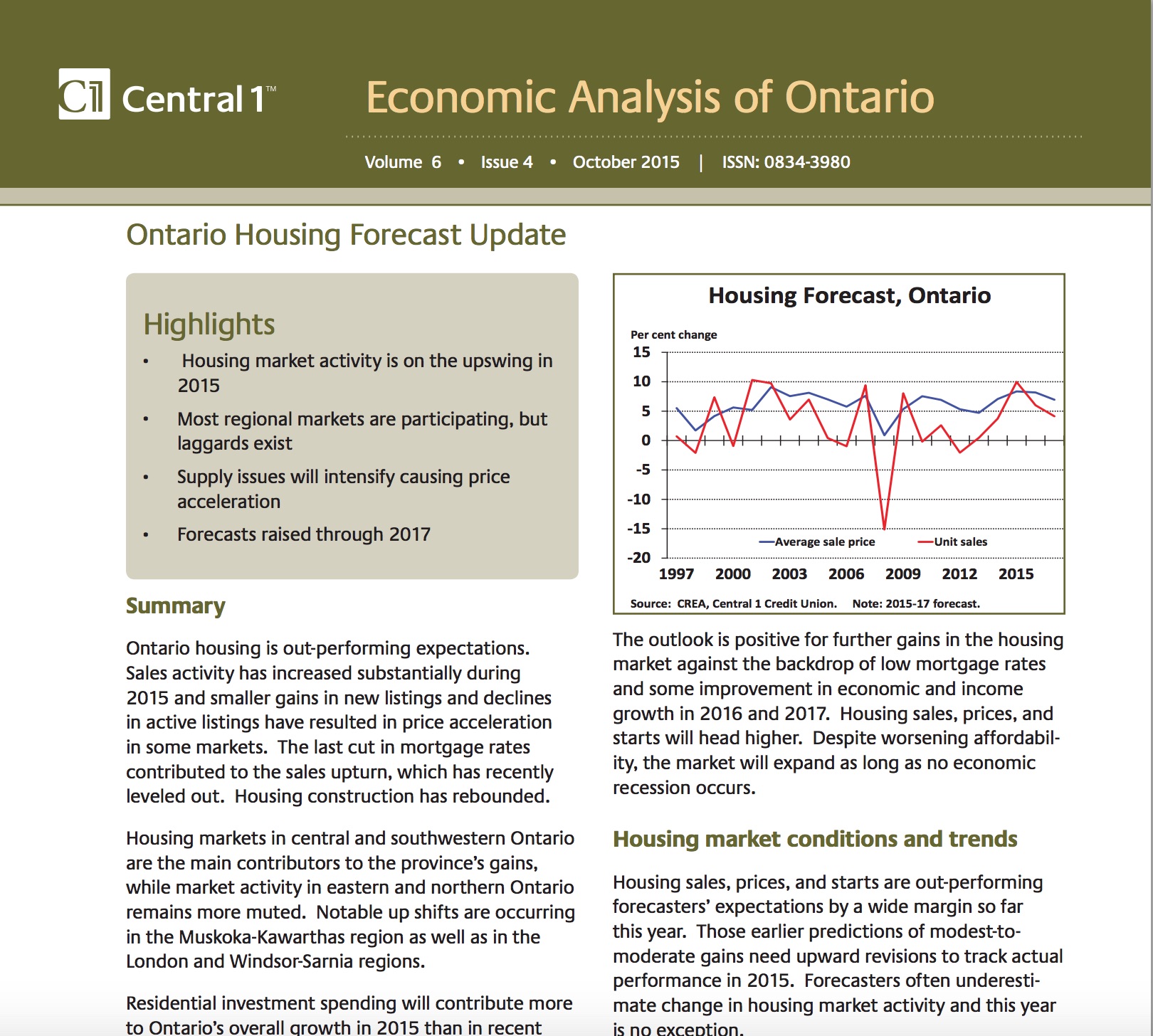

Ontario home prices, sales and starts will keep rising for the next two years, says a new forecast by Central 1 Credit Union. However, Ottawa’s growth rate, along with Sudbury and Thunder Bay, may be slower than some other areas of the province.

The surprising strength of the Ontario market this year has led Central 1’s chief economist Helmut Pastrick to boost his forecast for this year and 2016 and 2017.

“Sales have been strong this year but fewer new listings are coming on the market, so prices are rising in most regions,” Pastrick said. “Continued low mortgage rates have helped spur sales.”

The outlook is positive for further gains in the housing market against the backdrop of low mortgage rates and some improvement in economic and income growth in 2016 and 2017, Pastrick said.

“Home sales, prices, and starts will head higher,” he said. “Despite worsening affordability, the market will expand as long as no economic recession occurs.”

Highlights:

- Ontario MLS residential sales are up 10.5 per cent over last year

through to August. - The average sale price is up 8.1 per cent at $465,444.

- Greater Toronto sales were up 10.4 per cent year-to-date in August,

while sales in Hamilton-Burlington rose 11.5 per cent, Niagara Region

sales were up 14.9 per cent, and Windsor-Essex sales climbed 18.3 per

cent. - Sales in Ottawa, Sudbury, and Thunder Bay registered only single-digit

gains. - Residential sales are now expected to come in 9.8 per cent higher than

last year at 226,100 units. The average sale price forecast is raised to

$466,000 from $453,000 previously, an 8.1 per cent rise over 2014. - Prices are expected to climb to new records in 2016 and 2017, reaching

an average annual price of $538,000. - Housing starts are now forecast at 67,600 units this year, compared to

61,300 units previously, a 14.3 per cent increase over 2014, largely due

to condo construction in Toronto. - Starts are expected to rise each year reaching 72,100 units in 2017.

Read the full report Ontario Housing Forecast Update 2015-2017.